Sign Up With Wyoming Federal Credit Union: Secure and Member-Focused Financial

Sign Up With Wyoming Federal Credit Union: Secure and Member-Focused Financial

Blog Article

Federal Cooperative Credit Union: Your Trick to Better Financial

Federal Credit rating Unions use an unique technique to financial that prioritizes their participants' monetary well-being. With an emphasis on offering affordable rates and tailored services, they stand apart as a affordable and customer-centric choice for people looking for to achieve their monetary goals. Yet what sets Federal Credit rating Unions in addition to typical banks, and why should you think about making the button? Allow's check out the crucial benefits that make Federal Lending institution your gateway to better banking options.

Advantages of Federal Cooperative Credit Union

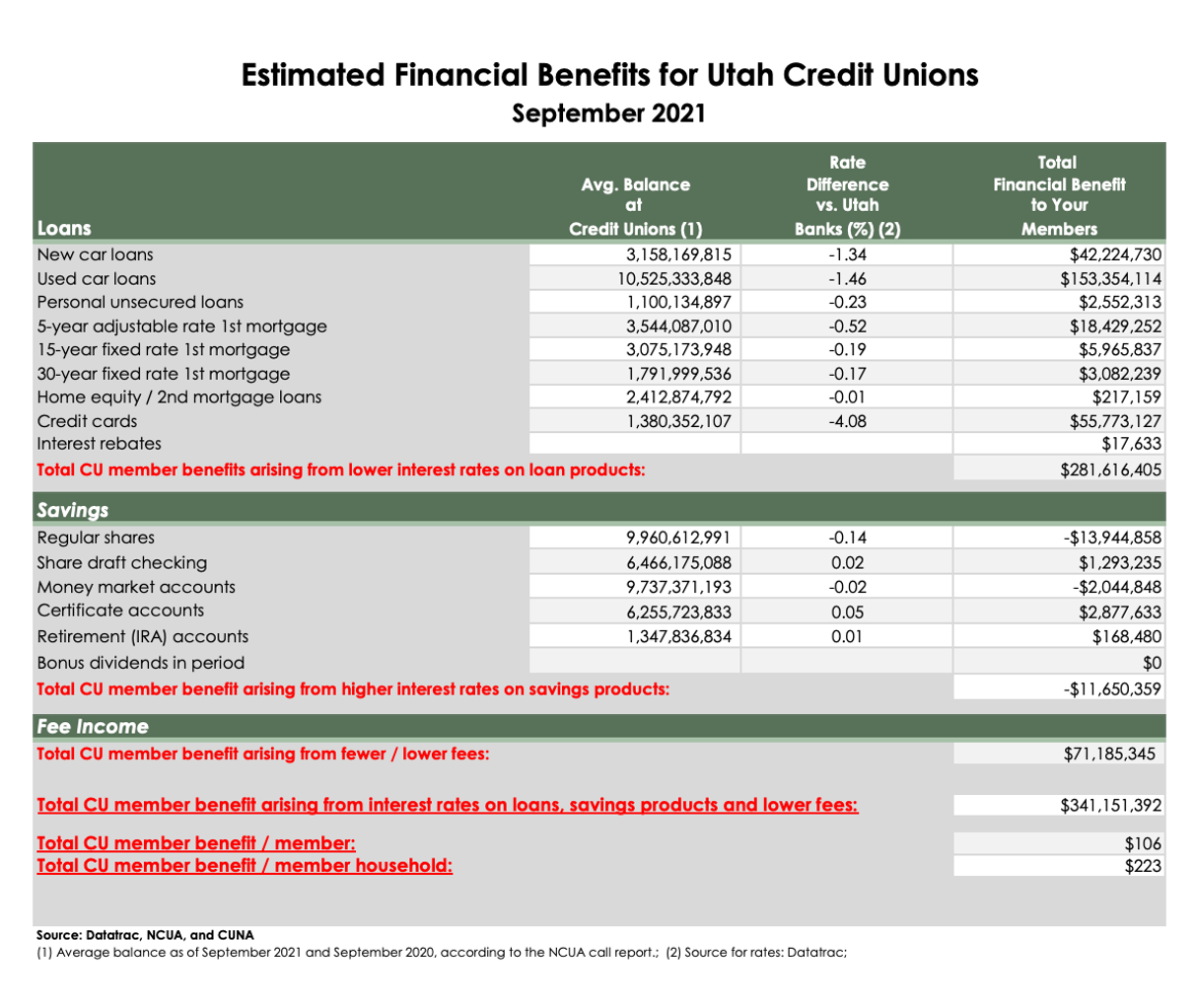

Federal Cooperative credit union use a series of benefits for participants seeking an extra community-oriented and individualized banking experience. One considerable advantage is the focus on offering their participants rather than taking full advantage of earnings. This member-focused strategy typically equates right into higher rates of interest on cost savings accounts, lower rate of interest on loans, and fewer fees contrasted to traditional banks. In Addition, Federal Lending institution are understood for their commitment to financial education and therapy. Participants can access sources to boost their monetary literacy, make far better choices, and job in the direction of their lasting goals.

An additional advantage of Federal Credit score Unions is their autonomous framework. Members have a say in exactly how the lending institution is run by electing for board members and getting involved in vital decisions. This offers participants a sense of possession and empowerment over their monetary establishment. Furthermore, Federal Debt Unions typically have strong connections to the local neighborhood, sustaining small organizations, charities, and initiatives that benefit their participants. On the whole, the benefits of Federal Cooperative credit union create a more encouraging and comprehensive financial setting for those searching for a tailored and community-centered technique to finance.

Member-Focused Providers Used

With a strong emphasis on member fulfillment and economic health, Federal Credit report Unions give a varied array of member-focused solutions customized to meet individual demands. Additionally, Federal Credit scores Unions commonly provide accessibility to unique participant advantages such as discounted rates on car loans, higher rate of interest rates on cost savings accounts, and forgoed charges for certain purchases. By focusing on member demands and providing customized solutions, Federal Credit history Unions stand out as establishments dedicated to supplying top-notch financial experiences for their participants.

Affordable Rates and Fees

When it concerns borrowing cash, Federal Credit scores Unions commonly offer lower interest prices on car loans, including car car loans, mortgages, and individual financings. This can cause significant cost savings for members over the life of the loan compared to borrowing from a typical financial institution. Additionally, Federal Credit rating Unions usually have less and lower charges for services such as over-limits, ATM usage, and account upkeep, making them an economical choice for people looking for financial services without too much fees. By focusing on the financial health of their members, Federal Credit scores Unions proceed to stick out as a economical and reliable banking article choice.

Financial Goals Success

An essential element of handling individual funds effectively is the successful accomplishment of financial goals. Establishing possible and clear financial objectives is essential for individuals to work towards a protected economic future. Federal cooperative credit union can play a crucial function in assisting members accomplish these goals with numerous financial product or services customized to their demands.

One common monetary objective is saving for a major acquisition, such as a home or an auto. Federal credit score unions use competitive interest-bearing accounts and investment choices that can assist members expand their money in time. By functioning very closely with members to comprehend their objectives, lending institution can offer tailored suggestions and solutions to assist in savings goals.

One more vital economic objective for several individuals is debt repayment. Whether it's student car loans, charge card debt, or various other liabilities, federal cooperative credit union can supply combination fundings and debt management approaches to aid members repay financial obligation successfully. By decreasing passion prices and streamlining payment schedules, read lending institution support participants in accomplishing financial freedom and security.

Why Select a Federal Lending Institution

Federal cooperative credit union stand apart as beneficial monetary institutions for individuals looking for a much more customized method to banking solutions customized to their monetary goals and details requirements. One key factor to select a government cooperative credit union is the member-focused approach that controls these establishments. Unlike conventional banks that focus on profits for shareholders, lending institution are possessed by their members, meaning the emphasis gets on supplying worth and benefits to those that bank with them. Furthermore, government credit rating unions usually supply lower fees, affordable rate of interest, and a much more customer-centric method to service. This equates right into expense financial savings and a much more tailored financial experience for participants.

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

Conclusion

To conclude, Federal Cooperative credit union offer a member-focused method to financial, giving affordable rates, personalized services, and assistance for attaining monetary goals. Cheyenne Credit Unions. With greater passion rates on cost savings accounts, reduced passion prices on car loans, and less fees than conventional banks, Federal Credit report Unions attract attention as a customer-centric and cost-efficient option for people looking for far better financial choices. Choose a Federal Lending Institution for a more financially secure future

Federal Debt Unions use a distinct strategy to financial that prioritizes their participants' monetary well-being. By focusing on member requirements and supplying tailored services, Federal Credit report Unions stand out as organizations devoted to supplying superior banking experiences for their participants.

By prioritizing the monetary health of their participants, Federal Debt Unions proceed to stand out as a reputable and budget friendly financial alternative.

Whether it's pupil fundings, credit rating card debt, or various other liabilities, government credit score unions can offer loan consolidation financings and financial obligation administration techniques to help participants pay off financial obligation successfully (Credit Unions Cheyenne).Federal credit unions stand out as beneficial economic establishments for individuals seeking a more personalized approach to financial solutions customized to their financial goals and certain demands

Report this page